Cory Doctorow has made an interesting observation, higher executive pay leads to worse pay for the employees.

Where do you think the highly paid executive gets his money from?

He takes it from his workers:

Broadly speaking, the role of an establishment economist is to come up with new ways of saying, "actually, your boss is right." In other words, the world we're living in is the best possible world, and the fact that you got contact burns from collapsing on the scorching sidewalk outside of the grocery store where you couldn't afford your weekly shopping is unfortunate, but unavoidable.

I once had an economist send me an email to explain how misguided it was to focus on executive pay. Sure (he wrote), executives might be taking home eye-popping sums, but these weren't really coming at the expense of their workers' wellbeing. Just do the math: take those whopping CEO pay-packages and parcel them out to the hundreds of thousands of workers at Fortune 100 companies, and you'll find that each worker's paycheck is just a few dollars larger. Hacking away at CEO pay is an act of spite, not justice.

Meanwhile (the economist continued), just look at where those giant paydays are coming from: stock grants, not salaries. In the bad old days, CEOs' millions came in the form of cash. That incentivized short-term thinking, since anything the CEO did to goose the quarterly numbers would translate into a cash bonus, even if it set the company up for failure in the years to come. But if a CEO's payout comes long after their decisions – if their stock grants don't vest for three or four years – then the CEO's incentives are aligned with long-term sustainability, which is good for everyone.

It's all nonsense, of course – every bit of it.

Take the question of whether controlling CEO pay is useful as a matter separate from the impact it has on workers' wages. In our society, money is power, and the more money any individual is allowed to amass, the more power they amass. This power is then mobilized to acquire more money, and thus more power. Before you know it, the ultrawealthy are perverting every democratic institution we have. They buy the Supreme Court:

https://pluralistic.net/2023/04/06/clarence-thomas/#harlan-crow

They fill our elite universities with their doltish offspring:

https://pluralistic.net/2021/11/18/bipartisan-consensus/#meritocracy

They set the planet on fire:

https://pluralistic.net/2024/09/04/deferred-gratification/#selective-foresight

And they bankroll fascists:

https://pluralistic.net/2023/06/02/plunderers/#farben

So even if controlling wealth acquisition had no impact on workers' wages, it would be worth doing. But of course, cutting executive pay does have an impact on workers' wages. It's true that simply dividing a CEO's pay among their workforce yields pennies, but that's the wrong way to do the math (and economists know it).

Every year, the Institute for Policy Studies publishes a report called "Executive Excess," in which they track the gap between the compensation offered to corporate leaders and to the workers who generate all that money. This year's is a banger:

https://ips-dc.org/report-executive-excess-2024/

The report zeroes in on one weird trick that CEOs use to goose their compensation: stock buybacks. Buybacks are an illegal form of stock manipulation that is nevertheless widely practiced, thanks to the SEC's policy of stretching Rule 10b-18 of the Securities Exchange Act of 1934 to creates a "safe harbor" for conduct that violates the plain language of the SEA.

Yes, I have made the same point, see

here,

here,

here, here,

here, and

here.

………

Why would CEOs prefer buybacks to dividends? Because CEOs sit on tons of shares. Even if only some of those shares have vested, a CEO who uses this ruse to increase share prices can cash those shares out, borrow against the rest, and count on a big stock grant from shareholders who are grateful for their windfall.

………

Take Lowe's: over the past five years, CEO Marvin Ellison spent $43 billion on stock buybacks, netting $18 million for himself in the process. Now, Lowe's has 285,000 employees, half of whom earn less than $33,000/year. Divide Ellison's $18m among those workers and each of them would net a paltry $126/year. But if you were to share out the $43 billion Ellison had to piss up against a wall on stock buybacks among those workers, you'd be able to give every worker a $30,000 bonus, every year:

https://www.counterpunch.org/2024/09/02/the-low-wage-corporations-that-blew-half-a-trillion-dollars-to-inflate-ceo-pay/

Lowe's leads the "Low-Wage 100," IPS's index of the worst paying 100 companies out of the S&P 500. Over the past five years, the Low-Wage 100 has spent more than half a trillion dollars on stock buybacks. As with other companies, the CEOs of the Low-Wage 100 timed mass sell-offs of their shares to coincide with the buybacks:

………

The economists who campaigned to pay CEOs in stock were wrong about nearly everything. CEO compensation does come at the expense of a living wage for workers, and it doesn't build sustainable businesses focused on long-term value. The billions that Boeing spent on buybacks are billions that Boeing didn't spend on airworthiness:

………

What should we do about this? Well, for starters, the SEC should re-establish enforcement of the prohibition on stock buybacks and drop the absurd fiction that buybacks satisfy the safe harbor requirements of Rule 10b-18. We should end preferential tax treatment of capital gains, the money you get from owning something, which is taxed at a fraction of wages, the money you get from doing something. This would also have the side benefit of killing the "carried interest tax loophole," a rule designed for 16th century sea-captains (!!) that lets private equity looters duck billions in taxes:

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interestOn top of this, the IPS recommends:

- Taxing stock buybacks (the 2024 Democratic platform proposes quadrupling the existing tax on buybacks);

- Increase taxes for excessive CEO pay (a rule already in place in San Francisco and Portland and proposed in several federal bills);

- Ban companies that have absurd pay gaps from doing business with the US government (something a sitting president can do at the stroke of a pen).

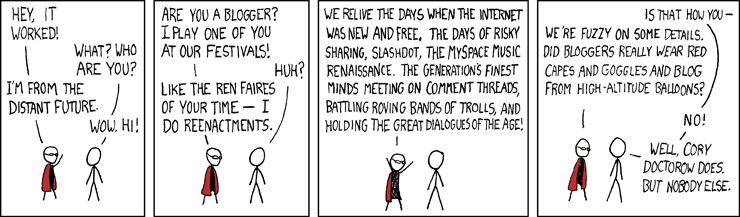

Nice to see someone who is so stylish, what with the cape, goggles, and hot air balloon, agreeing with me:

0 comments :

Post a Comment